Save time and avoid unnecessary fines.

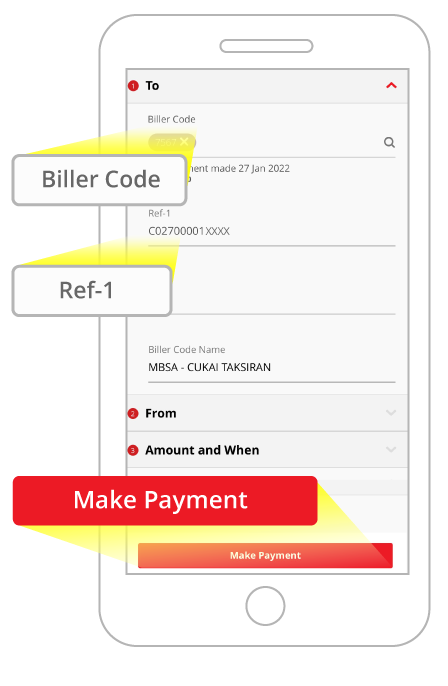

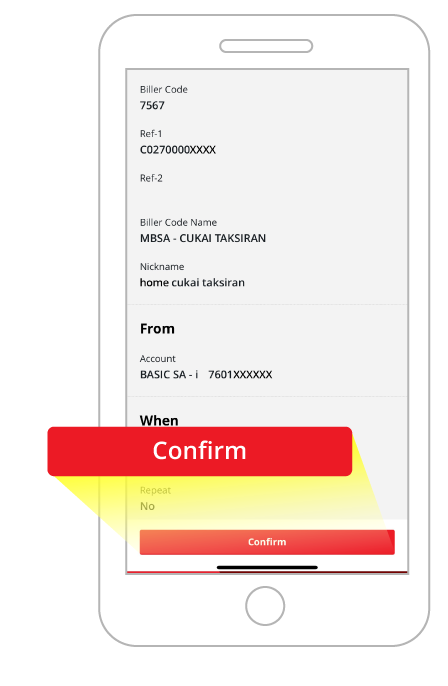

It is so easy to pay your local council online via JomPAY or FPX - just at your fingertips. Don't forget to sort out your Assessment Tax payments with CIMB Clicks before 28 February 2022!

Payment Period: 1 January 2022 - 28 February 2022